For Italian residents, a unit linked life insurance policy which complies with Italian law can provide access to a wide range of underlying investments whilst offering the highest possible levels of security and investor protection as well as the most favorable fiscal treatment.

Key benefits include;

- Dedicated range of institutional class, low cost, risk rated multi asset portfolios in Euro, GBP and USD.

- Access to personalized discretionary portfolios from leading British asset managers.

- Free choice of beneficiaries. Your estate can be passed on according to your wishes.

- Highly tax efficient for investing and drawing out income in Italy.

- Cedole option can provide a tax deferred withdrawal of up to 5% per annum.

- Changes in the underlying investments will not trigger a capital gains tax charge.

- Capital paid to beneficiaries in the event of death are not subject to inheritance tax in Italy.

- A range of enhanced insurance options are available for effective estate planning.

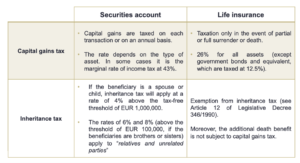

Tax benefits of Italian compliant life insurance compared with directly held investment

Taxes applicable to Italian residents

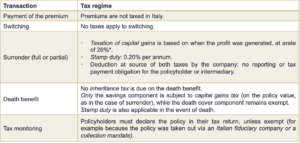

- The insurance company needs to have opted for the role of withholding agent and a licensed Italian insurance intermediary needs to be appointed.

- Taxation only on payment of benefits: in the case of surrender, policy maturity (for term policies) or payment of the death benefit.

- Gains and losses may be offset without limitation in terms of time or asset class.

- Exemption from inheritance tax on the death benefit, and exemption from capital gains tax on the capital paid out corresponding to coverage of demographic risk.

- The insurance company calculates, debits and pays the taxes (capital gains and stamp duty) due to the Italian authorities and complies with the reporting requirements.

Not all unit linked insurance Policies are tax efficient for Italian residents

For a unit linked insurance policy to be able to provide the benefits detailed above, there are some important points to be aware of:

- A registered Italian insurance intermediary should be appointed.

- Offshore policies usually do not qualify. We can help you to check if your policy is compliant for Italian residence.

- The insurance company should have adopted the role of withholding agent.

Transparent Fees and Charges

Italian compliant unit linked insurance policies are a safe, tax efficient and flexible wealth management solution.

We can help you to set up an Italian compliant policy with clear and easy to understand fees and charges.

We only use institutional class investments free of entry and exit charges and so the total costs may be considerably less than you are currently paying for a portfolio which is not suitable or efficient for Italian residence.

To make sure your savings and pensions are structured to be cost effective, tax efficient and compliant with your residence in Italy, please contact us by email on [email protected] to arrange a review.

Please also forward this article to any British friends who may find this helpful.